News

AWS Dominates Cloud Infrastructure Report for 9th Year

This year's report on cloud Infrastructure-as-a-Service (IaaS) from research firm Gartner Inc. is a lot like last year's report, further cementing the dominance of the "big three" in all things cloud computing, led by Amazon.

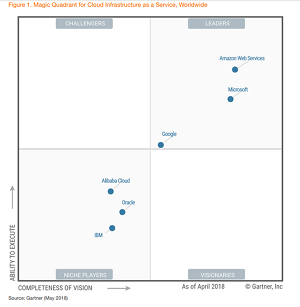

The 2019 "Magic Quadrant" report names Amazon Web Services Inc. (AWS), Microsoft and Google as leaders, with everyone else (Alibaba, Oracle and IBM) relegated to "niche player" status -- the exact same grouping as last year's report. AWS was awarded top status for the ninth year in a row.

In Gartner's view, the story of cloud IaaS was one of "consolidation" in 2017 and 2018 and "maturation" in 2019.

"The market views both AWS and Microsoft as being general-purpose providers capable of supporting a broad range of workloads," Gartner said in the 2019 report published last week. "Google is making steady progress in terms of enterprise adoption, but it remains in a distant third place in terms of overall annual revenue and interest among Gartner's enterprise clients. All other vendors in this market are forced to focus on regional dominance or niche workloads given the momentum of AWS and Microsoft, and the scale at which they operate."

While the 2019 report is almost a duplicate of the 2018 report, it's also remarkably similar to the 2017 report, except that Google -- grouped with Alibaba, Oracle and IBM in the "visionary" quadrant -- moved to "leaders," while the three second-tier vendors moved from "visionary" to "niche player" status and a whole bunch of former "niche players" were dropped altogether.

All that is better understood graphically, and here are the past three quadrant graphics:

[Click on image for larger view.]

Gartner 2019 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2019 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2018 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2018 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2017 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2017 IaaS Magic Quadrant (source: Gartner)

Gartner defined its market definition/description thusly:

Cloud computing is a style of computing in which scalable and elastic IT-enabled capabilities are delivered as a service using internet technologies. Cloud infrastructure as a service (IaaS) is a type of cloud computing service; it parallels the infrastructure and data center initiatives of IT. In the context of this Magic Quadrant, cloud IaaS is defined as a standardized, highly automated offering, where compute resources, complemented by storage and networking capabilities, are owned by a service provider and offered to the customer on demand. The resources are scalable and elastic in near real time, and metered by use. Self-service interfaces are exposed directly to the customer, including a web-based UI and an API. The resources may be single-tenant or multitenant, and hosted by the service provider or on-premises in the customer's data center. Thus, this Magic Quadrant covers both public and private cloud IaaS offerings.

With AWS dominating this market for nine years in a row, the research firm listed its strengths as including:

- Enterprises make larger annual financial commitments and deploy more mission-critical workloads on AWS than with any other hyperscale provider.

- AWS has a broader range of customer profiles, ranging from startups and small and midsize businesses (SMBs) to large enterprises, than any other provider in this market.

- AWS is the most mature, enterprise-ready provider, with the strongest track record of customer success and the most useful partner ecosystem.

Under "cautions" for AWS, the research firm said:

- AWS makes frequent proclamations about the number of price reductions it has made. Customers interpret these proclamations as being applicable to the company's services broadly, but this is not the case. For instance, the default and most frequently provisioned storage for AWS's compute service has not experienced a price reduction since 2014, despite falling prices in the market for the raw components.

- AWS prioritizes being first to market with respect to delivering new services and capabilities. As a result, it is willing to launch feature-poor services or services without deep cross-platform integration, which it often defers to the future to address. The quest to be first to market sometimes results in services that need years of substantial engineering updates.

- As the ambitions of Amazon's CEO expand into additional markets, the boards of directors for companies in potentially threatened verticals have directed their IT organizations to avoid the use of AWS where possible. This may ultimately limit AWS's success in some verticals, and may impact the associated ecosystem. IT leaders in these verticals should consider a contingency plan for board-level directives.

In summing everything up in a market overview, Gartner said: "The market for cloud IaaS is maturing, but revenue is growing unabated. Gartner projects revenue in the cloud IaaS market to increase to $81.5 billion by 2022, up from $41.4 billion in 2019. But most of the enterprise interest and revenue are currently directed toward two providers: AWS and Microsoft."

About the Author

David Ramel is an editor and writer at Converge 360.