News

Having Silenced IaaS Doubters, What's Next for AWS?

Well, Infrastructure as a Service (IaaS) works, and Amazon Web Services Inc.'s recent quarterly financial results report shows the cloud company is doing pretty well with it, at least temporarily silencing doubters as it continues to hold off stiff competition from some of the most powerful companies in the world. So now what?

"Amazon's public release of AWS' revenue and operating metrics gives the market long-awaited data around the public cloud IaaS business," said analyst Meaghan McGrath at Technology Business Research Inc. in a statement.

Amazon, of course, for the first time broke out AWS numbers in its quarterly financial earnings report on Thursday, showing the cloud division is indeed profitable and outperforming many analysts' expectations. "Amazon Web Services is a $5 billion business and still growing fast -- in fact it's accelerating," said Amazon.com CEO Jeff Bezos in a prepared statement.

[Click on image for larger view.]

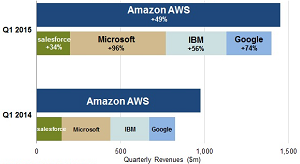

Cloud Infrastructure Services Revenue Growth (IaaS, PaaS, Private and Hybrid Services). (Source: Synergy Research Group)

[Click on image for larger view.]

Cloud Infrastructure Services Revenue Growth (IaaS, PaaS, Private and Hybrid Services). (Source: Synergy Research Group)

"There has been much skepticism in the market around the viability of cloud models as many of the largest publicly traded [Software-as-a-Service] SaaS vendors such as Salesforce and Workday have negative operating margins year after year," McGrath said. "Further, IaaS is charged on a usage basis (whereas SaaS is a subscription), further making the business model risky. However, with [the] AWS announcement, the market can rest assured there is profit to be made in cloud and that the business model and (successful) vendors are here to stay."

The market can also rest assured that AWS will stay at the top of the list of those vendors -- at least for the time being.

"AWS remains larger than its four main competitors combined in the cloud infrastructure service market,"

noted Synergy Research Group yesterday.

Of those four main competitors, Microsoft and its Azure service remain paramount, and others are furiously trying to cut out their piece of the cloud pie.

"Microsoft can once again lay claim to having by far the highest revenue growth rate, and IBM remains the king of the private and hybrid services segment, but AWS continues to grow faster than the market as a whole and its market share crept up to 29 percent in the quarter," Synergy said. "Google is quietly gaining share, though it remains just half the size of Microsoft in this market, while Salesforce, once the unquestioned leader in [Platform as a Service] PaaS, rounds out the top five ranked companies." Synergy noted in February that AWS market share had hit a five-year high.

Now, going forward, analysts expect the company's aggressive business moves to continue, matching competitors' price cuts, constantly introducing new products and services and seeking to innovate cloud services.

McGrath noted several of these recent business moves, such as the recent launching of the WorkMail managed e-mail and calendar offering, unlimited Cloud Drive storage, the Amazon WorkSpaces Application Manager (Amazon WAM) to manage companies' own applications along with apps bought from the young AWS Marketplace for Desktop Apps. "Together, these announcements suggest that AWS will continue to expand its enterprise application suite to compete more directly with productivity suites, namely Google's," she said.

Another big move was the introduction of Amazon Machine Learning to compete with the likes of IBM Watson Analytics and Microsoft Azure Machine Learning. "TBR expects this solution will be supplemented with additional analytics offerings across 2015, to build more comprehensive, managed Big Data solutions," the Technology Business Research analyst said.

Synergy noted there was plenty of room for growth in the cloud market, especially in the IaaS niche dominated by AWS. "On a strict like-for-like basis, AWS remains streets ahead of the competition in cloud infrastructure services," Synergy said. "Furthermore, this part of the cloud market is growing much more rapidly than SaaS or cloud infrastructure hardware and software."

The potential for AWS growth is so great that company CTO Werner Vogels told CNBC that it could overtake Amazon's retail business in 10 years.

"This is a huge opportunity and as such Jeff Bezos, our CEO and founder, has said several times that he believes the opportunity is so big that maybe AWS, over time, may become bigger than the retail company," Vogels said.

About the Author

David Ramel is an editor and writer at Converge 360.